About Me

I was just fifteen when I first got into the world of equities. My father, an investor, roped me in as his research partner. We spent countless evenings analyzing balance sheets, reading market trends, and debating which stocks were worth a second look.

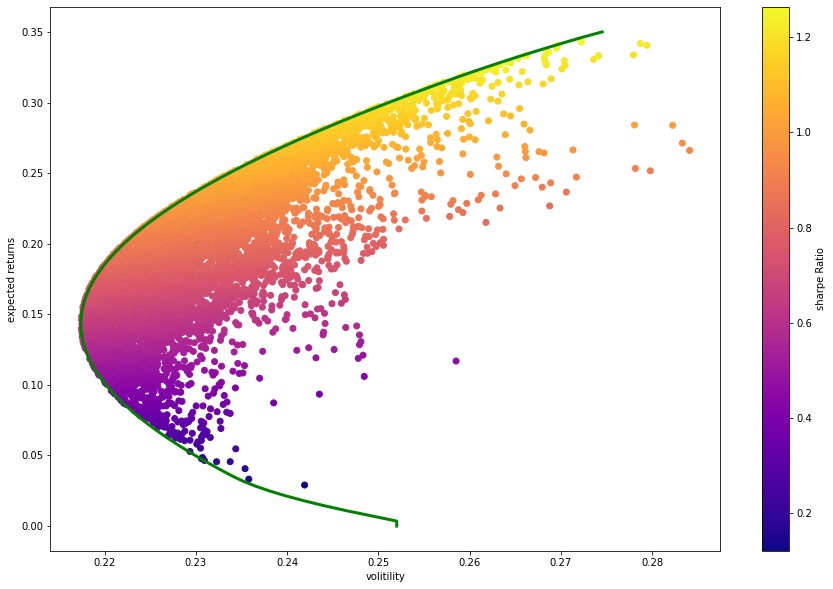

Little did I know those simple father-son lessons would fuel a lifelong passion for investing, leading me to build a strong foundation and potentially grow into a confident successful investor. My goal is to merge fundamental research with quantitative methods, creating a unique approach that translates data into clear, strategic insights and investment decisions.

When I’m not crunching data or plotting the next investment move, you’ll probably find me with a ping pong paddle in hand. I’ve been hooked on the sport since I was twelve, competing in multiple state tournaments and still chasing that perfect backhand. You can often catch me at PingPod on West 37th or West 99th. I’m a passionate F1 fan cheering for Max Verstappen, and I love diving into strategy games like Call of Duty, Fortnite, FIFA, and F1.

Skills

Experience

Education

- Finance

Financial Modelling, Accounting, Bloomberg, Refinitiv Workspace - Analytics

Python, R, Tableau, Mathematics, Statistics, Machine learning - Economics

Macroeconomics, Microeconomics, Econometrics

- Jan 2025 - Current

Adjunct Associate (Teaching Blockchain) at Columbia University - Jun 2024 - Current

Financial Analytics at Ascot Group LLC - Jan 2024 - May 2024

Investment Banking Intern at Nova Capital - Jun 2023 - Jun 2024

Financial Data Research Assistant at Columbia University - Mar 2022 - May 2022

Business Analyst at AMN life Science - Jan 2021 - Jun 2021

Equity Research Intern at CLSA - Jan 2020 - Mar 2020

Capital Markets Consultant at Knight Frank

- Sept 2022 - Dec 2023

MSc in Applied Analytics - Columbia University - Aug 2019 - Aug 2020

PGDM in Economics and Data Analytics - Gokhale Institue of Politics and Economics - Jan 2019

Chartered Financial Analyst - Passed level 1 (CFA Institute) - May 2016 - June 2019

BAF (Accounting and Finance) - Mumbai University