About Me

I was fifteen when my father, an investor, made me his research partner. We'd spend evenings analyzing balance sheets, debating valuations, and building conviction on positions. That early discipline - turning raw data into investment decisions - is still what drives me today.

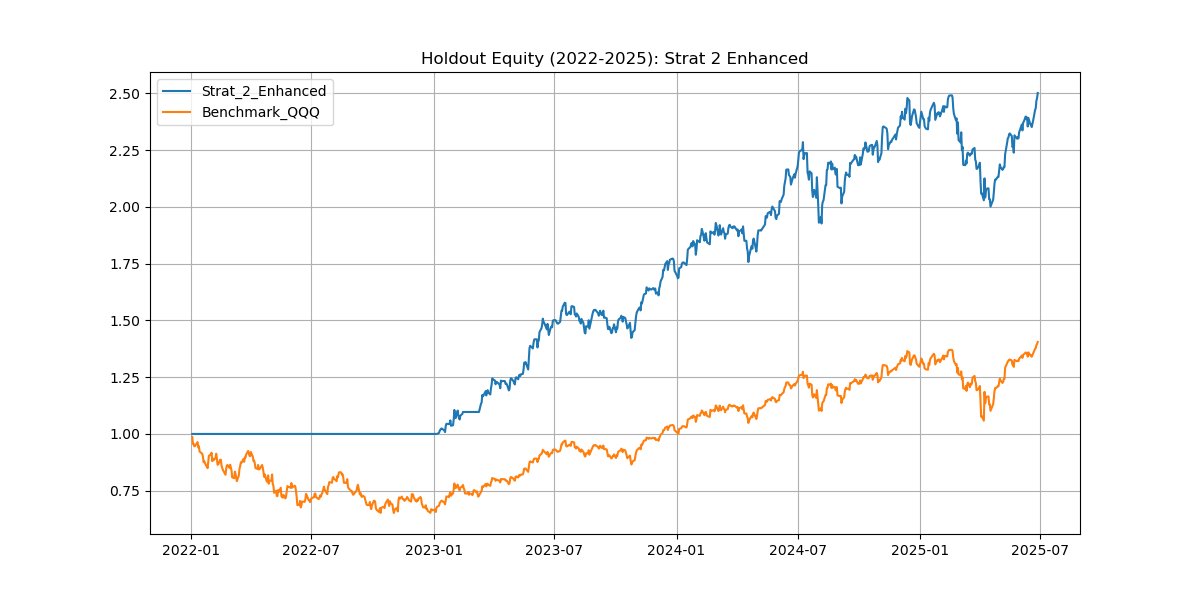

I now focus on building systematic, research-driven investment strategies that sit at the intersection of quantitative methods and fundamental intuition. My work spans portfolio construction (Mean-Variance, Black-Litterman, factor models), risk analytics (VaR, drawdown analysis, regime detection), and macro-aware signal design - most recently a multi-factor QQQ strategy that achieved a 1.55 Sharpe on blind out-of-sample data, earning a Quanta Ventures Fellowship selection (Top 5%).

I'm looking to bring this toolkit to an asset manager, bank investment team, or wealth management strategy desk - anywhere that values decision-ready portfolio research, disciplined risk frameworks, and someone who can translate complex quantitative analysis into clear investment narratives.

When I'm not building models, you'll find me at PingPod with a ping pong paddle, watching Max Verstappen in F1, or deep in a strategy game.

Skills

Experience

Education

- Portfolio & Risk

Portfolio Construction, Mean-Variance Optimization, Black-Litterman, Factor Models (Fama-French), Risk Attribution, VaR/CVaR, RAROC, Stress Testing, Scenario Analysis, Regime Detection - Quantitative Methods

Statistical Modelling, Time Series Econometrics (ARIMA, VAR, GARCH), Optimization, Machine Learning (XGBoost, Random Forest, SVR, Neural Networks), Monte Carlo Simulation - Technical

Python (Scikit-learn, Pandas, NumPy, Matplotlib), R, SQL, KDB+/q, VBA, C++, Apache Spark, MongoDB, Neo4j, Linux - Platforms & Visualization

Bloomberg Terminal, Refinitiv Workspace, Tableau

- May 2025 - Jan 2026

Quantitative Data Analyst at Insyst, INC - Jun 2024 - May 2025

Quantitative Risk & Portfolio Analyst at Ascot Group LLC - Jun 2023 - Jun 2024

Quantitative Strategist (Research) at Columbia University - Jan 2024 - May 2024

Investment Banking Intern at Nova Capital - Mar 2022 - May 2022

Business Intelligence Analyst at AMN life Science - Jan 2021 - Jun 2021

Equity Research Analyst at CLSA - Dec 2019 - Aug 2020

Econometrics Research Associate at Meghnad Desai Academy of Economics

- Sept 2022 - Dec 2023

MSc in Applied Analytics - Columbia University - Aug 2019 - Aug 2020

PGDM in Econometrics (Quantitative Economics) - Meghnad Desai Academy of Economics - Jan 2019

Chartered Financial Analyst - Passed level 1 (CFA Institute) - May 2016 - June 2019

BSc in Finance - Mumbai University